Introduction

The world of mergers and acquisitions (M&A) is a dynamic one, marked by high stakes and the potential for great rewards. When companies engage in M&A transactions, they embark on a journey that can lead to significant growth, expanded market presence, and increased shareholder value. However, this journey is not without its challenges, and one of the critical checkpoints along the way is due diligence.

Due diligence is the meticulous process through which acquiring companies scrutinize and evaluate a target company before sealing the deal. It serves as a reality check, helping potential buyers unearth hidden risks, potential liabilities, and growth opportunities. Traditionally, this process was arduous, time-consuming, and heavily reliant on human expertise. But the advent of Artificial Intelligence (AI) has ushered in a new era, transforming the landscape of M&A due diligence in ways that were previously unimaginable.

The Evolution of Due Diligence

Before we dive headfirst into the world of AI-powered due diligence, let’s take a step back and understand how due diligence has evolved over the years.

Traditional Due Diligence

Historically, due diligence primarily involved reviewing stacks of documents, spreadsheets, financial statements, and legal contracts. Experts from various fields, including finance, law, and accounting, would meticulously comb through these documents, seeking answers to critical questions.

- Are the financial statements accurate?

- Are there any undisclosed liabilities?

- What is the target company’s market position?

- Are there any ongoing legal disputes?

- What are the growth prospects for the target company?

These were just a few of the many questions that needed to be answered to ensure that an M&A transaction proceeded with confidence. However, this manual, time-consuming process often left room for oversights and human errors. Moreover, in an era of rapidly evolving technology and data proliferation, it became clear that traditional due diligence needed a radical overhaul.

The Rise of AI in Due Diligence

Enter Artificial Intelligence, a technological juggernaut that has revolutionized virtually every industry it has touched. M&A due diligence is no exception. AI, particularly in the form of machine learning and natural language processing (NLP), has emerged as a game-changer in how companies assess potential targets.

Automating Data Collection

One of the most labor-intensive aspects of due diligence is data collection. Traditionally, teams of professionals would spend countless hours gathering data from various sources—financial reports, legal contracts, regulatory filings, and more. The introduction of AI has streamlined this process to an astonishing degree.

Natural Language Processing (NLP)

NLP, a branch of AI focused on enabling machines to understand, interpret, and generate human language, has found its stride in due diligence. NLP algorithms can process vast amounts of textual data with remarkable speed and accuracy.

Imagine being able to feed a trove of legal contracts into an AI system and having it extract critical clauses, identify potential risks, and provide a summarized overview—all in a fraction of the time it would take a team of human experts. NLP makes this possible.

Advanced Financial Analysis

Financial due diligence is at the core of M&A, and AI is flexing its muscles here as well. Machine learning algorithms, in particular, have proven invaluable in analyzing financial data.

Predictive Modeling

AI-driven predictive models can do more than just crunch numbers; they can forecast the financial performance of a target company post-acquisition. By considering an array of variables, including historical data, market conditions, and industry trends, these models provide acquirers with invaluable insights into the potential return on investment.

Enhanced Risk Assessment

Identifying and assessing risks is paramount in due diligence, and AI brings a heightened level of sophistication to this crucial task.

Machine Learning for Risk Identification

Machine learning models, fueled by vast datasets, can identify patterns and anomalies in a target company’s historical data. These models go beyond the capabilities of traditional risk assessment methods by flagging potential red flags that might have otherwise gone unnoticed.

For instance, a machine learning algorithm can detect irregularities in a company’s financial statements, uncovering potential accounting discrepancies or fraud. It can also assess industry-specific risks, regulatory compliance, and contractual obligations, reducing the likelihood of post-acquisition surprises.

Market and Competitive Analysis

Understanding the target company’s position in the market and its competitive landscape is essential for a successful acquisition. AI lends a helping hand by analyzing extensive market data and competitor information.

Competitive Intelligence

AI-driven competitive intelligence tools can monitor competitor activities, track market trends, and gauge customer sentiment. This real-time insight provides acquirers with a comprehensive view of the competitive landscape, helping them assess the target company’s competitive advantage and its ability to thrive in the market post-acquisition.

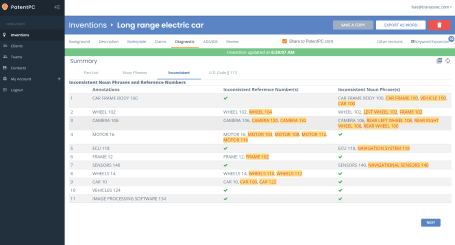

Intellectual Property (IP) Due Diligence

In industries where intellectual property plays a pivotal role, such as technology and pharmaceuticals, conducting IP due diligence is paramount. AI expedites the process of reviewing patents, trademarks, copyrights, and more.

USPTO Database Analysis

The United States Patent and Trademark Office (USPTO) maintains an extensive database of intellectual property records. AI-powered algorithms can search and analyze this database swiftly, identifying potential IP issues such as conflicts, infringement risks, or opportunities for innovation. This capability is particularly invaluable when dealing with companies with a substantial IP portfolio.

The Benefits of AI in M&A Due Diligence

The integration of AI into the due diligence process is not merely a technological advancement; it’s a game-changer that brings forth a plethora of benefits for acquirers. Let’s explore these advantages:

1. Efficiency and Speed

AI-powered tools can process and analyze vast amounts of data at lightning speed. What used to take weeks or even months can now be accomplished in a fraction of the time. This efficiency not only accelerates the due diligence process but also enables acquirers to respond swiftly in a competitive M&A landscape.

2. Accuracy and Data Quality

AI is renowned for its precision. It doesn’t suffer from human biases or fatigue. When it comes to data extraction, analysis, and risk assessment, AI consistently delivers accurate results. This high level of accuracy minimizes the chances of overlooking critical information or making decisions based on flawed data.

3. Scalability

The scalability of AI is a remarkable asset. Whether you’re dealing with a small-scale acquisition or a massive merger involving multiple subsidiaries, AI can adapt seamlessly. It can handle diverse data sources, multiple languages, and various industries without breaking a sweat.

4. Deeper Insights and Predictive Capabilities

AI doesn’t stop at providing surface-level information. It can dive deep into data, uncovering hidden patterns and insights that might elude human reviewers. Furthermore, AI-driven predictive models offer the ability to forecast future scenarios, aiding in strategic decision-making.

5. Reduced Resource Requirements

AI doesn’t replace humans in the due diligence process; it augments their capabilities. This means that human experts can focus on higher-level tasks, such as strategy development and risk assessment, while AI handles data-intensive grunt work. As a result, organizations can optimize resource allocation.

6. Enhanced Risk Mitigation

The ability of AI to identify risks with precision is a tremendous asset. By flagging potential issues early in the due diligence process, acquirers can take proactive steps to mitigate those risks, whether through renegotiations, contingency plans, or risk-sharing arrangements.

7. Improved Decision-Making

Ultimately, the goal of due diligence is to make informed decisions. AI equips acquirers with a wealth of data-driven insights that enhance decision-making. Whether it’s determining the fair value of a target company, assessing market dynamics, or evaluating potential synergies, AI-powered due diligence provides a solid foundation for strategic choices.

The Future of AI in M&A Due Diligence

AI’s role in M&A due diligence is poised for continued growth and evolution. Here’s what the future may hold:

1. Ongoing Technological Advancements

AI technologies are continually advancing, and future iterations of AI tools will likely be more capable and sophisticated. Improved natural language processing, more accurate predictive modeling, and enhanced data visualization are on the horizon. These advancements will further streamline the due diligence process and provide deeper insights.

2. Integration with Blockchain and Cybersecurity

Blockchain technology, known for its transparency and security, may integrate with AI in due diligence. This integration could ensure the authenticity of documents, trace the provenance of assets, and enhance data security. Additionally, AI-driven cybersecurity tools will play a critical role in safeguarding sensitive due diligence data from cyber threats.

3. The Role of AI in Post-Acquisition Integration

AI’s utility doesn’t end with the due diligence phase. Post-acquisition, AI can assist in integrating acquired companies seamlessly. It can optimize processes, harmonize IT systems, and facilitate cultural alignment. AI-powered analytics can monitor the progress of integration efforts, ensuring that synergy goals are met.

4. Predictions and Trends

Predictive analytics will become even more central to due diligence. Future AI models will forecast not only financial performance but also operational synergies, customer behavior, and regulatory changes. This foresight will enable acquirers to proactively address challenges and capitalize on emerging opportunities.

5. Enhanced Collaboration

AI will foster greater collaboration between human experts and machines. Experts will leverage AI tools to expedite data analysis and focus on strategic decision-making. Human oversight will remain critical to ensure ethical AI use and to interpret nuanced findings.

6. Expanded Industry Applications

While AI has made significant inroads in due diligence across industries, it will likely expand its reach to sectors that have been slower to adopt, such as manufacturing and traditional retail. As AI becomes more accessible and tailored to specific industry needs, its adoption will become more widespread.

As we look ahead, it’s evident that AI will continue to shape the landscape of M&A due diligence, enabling companies to conduct faster, more accurate assessments and make more informed decisions. While AI presents opportunities, it also raises ethical and regulatory considerations that must be addressed responsibly.

Ethical and Legal Considerations in AI-Enhanced Due Diligence

As AI plays an increasingly prominent role in due diligence, several ethical and legal considerations come to the forefront:

1. Data Privacy Regulations

AI systems rely heavily on data, often including personal or sensitive information. Adhering to data privacy regulations, such as the European Union’s General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA), is paramount. Acquiring companies must ensure that AI-powered due diligence processes comply with these laws to avoid regulatory penalties.

2. Bias and Fairness in AI

AI algorithms can inadvertently inherit biases present in training data. This can lead to unfair outcomes, particularly in risk assessment or predictive modeling. It’s crucial to implement measures to detect and mitigate bias in AI systems, ensuring that decisions are fair and equitable.

3. Accountability and Transparency

AI-driven decisions can be opaque, making it challenging to understand how conclusions are reached. To address this, there’s a growing need for transparency in AI systems. Acquiring companies should strive to provide clear explanations for AI-driven findings and decisions, ensuring accountability.

4. Legal Liability Issues

If AI systems make erroneous or harmful recommendations during due diligence, legal liability questions arise. Who is responsible for these errors—the AI developers, the acquiring company, or both? Clear contractual agreements and risk assessments are vital to mitigate legal disputes.

Navigating these ethical and legal considerations necessitates a proactive approach. Acquiring companies must develop comprehensive AI ethics policies, conduct regular audits of AI systems, and establish clear governance frameworks to ensure responsible AI use in M&A due diligence.

Conclusion

The landscape of mergers and acquisitions (M&A) due diligence is undergoing a profound transformation, driven by the integration of Artificial Intelligence (AI). This technological revolution is reshaping the way acquiring companies assess potential targets, from automating data collection to conducting advanced financial analysis and enhancing risk assessment.

However, AI’s adoption also comes with challenges and considerations, such as data privacy, integration complexity, skillset gaps, ethical concerns, and regulatory compliance. Addressing these issues requires a thoughtful and strategic approach to ensure responsible AI use.

Looking to the future, AI’s role in M&A due diligence is poised for continued growth. Ongoing technological advancements, integration with blockchain and cybersecurity, and an increased focus on post-acquisition integration will further enhance its capabilities. AI will also foster greater collaboration between human experts and machines, expanding its applications across various industries.

As AI continues to revolutionize M&A due diligence, organizations must strike a balance between harnessing the power of AI and maintaining ethical and legal integrity. With responsible AI use, companies can embark on their M&A journeys with greater confidence, efficiency, and success.

In closing, the role of AI in M&A due diligence is not just a technological advancement; it’s a fundamental shift in how companies approach one of the most critical phases of the M&A process. It’s a journey that promises greater efficiency, accuracy, and strategic decision-making—a journey that is just beginning.